In some states, insurers offer a dividend program option for Workers Compensation policies as an incentive to pursue safety measures. The short story is this: the fewer WC claims made against your insurer, the greater your dividend payment ( or premium credit ) may be at the end of the year, according to your insurer's dividend schedule.

A dividend program (also called a participating plan) is a rating plan that allows businesses to share in the profits of the workers compensation insurer. It pays a dividend to businesses that have prioritized workplace safety and successfully controlled their losses.

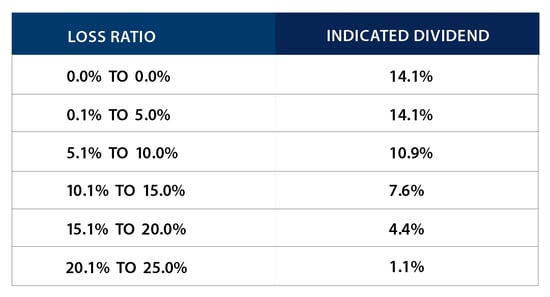

For instance if you qualify for the option in your state, it may look like:

The chart below demonstrates how a business with a $100,000 premium and a 0% loss ratio may receive a 14.1% returned premium at the end of the policy term.

It is important to remember that the dividend is not guaranteed because it depends on the financial health of the carrier, not the individual health of your own business. However, if a dividend program is available and your insurer is in good financial health, the payment or premium credit is likely to occur.

DII experts can help you navigate a dividend program, and help your business pursue safety measures that will reduce your loss ratio as much as possible in order to maximize this program if it is available in your state.

Let Us Know What You Thought about this Post.

Put your Comment Below.